What is Financial Freedom?

https://www.ellisbates.com/wp-content/uploads/2023/07/Financial-Freedom.jpg 560 315 Jess Easby Jess Easby https://secure.gravatar.com/avatar/70f816837c455030814d46a740cfc12d89893aaf8cbf8c8f8f59387d7b30ac08?s=96&d=mm&r=g Professional financial advice matters by helping you make informed decisions about how to best allocate your resources.

Professional financial advice matters by helping you make informed decisions about how to best allocate your resources.

Financial planning is a crucial step towards achieving financial freedom and security. By taking the time to thoroughly evaluate your needs and personal goals, you’ll be able to make informed decisions about how to best allocate your resources.

With a comprehensive professional financial plan in hand, you’ll have the confidence and peace of mind to pursue your short-term goals and work towards your long-term future. With professional guidance, you’ll be inspired to realise that you have far more resources at your disposal than you ever imagined.

Early retirement

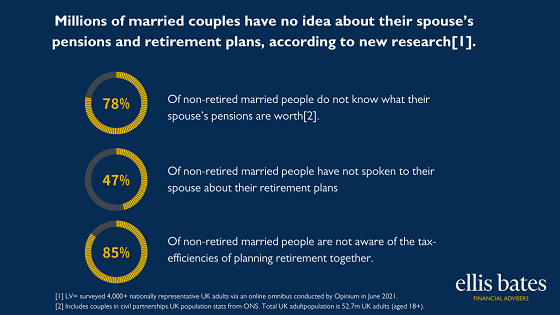

According to a recent study, UK consumers who receive professional financial advice can expect to retire on average three years earlier than those who do not seek professional advice, with advised consumers planning for retirement at age 66 as opposed to non-advised consumers who expect to retire at 69[1].

This underlines the positive impact that professional financial advice can have on retirement preparations, with those who seek advice feeling better equipped for their later years. The study identified that twice as many people who seek financial advice create a detailed spending plan in retirement compared to those who don’t take advice, with 45% of advised people falling under this category as opposed to 18% of non-advised consumers.

Enjoying retirement

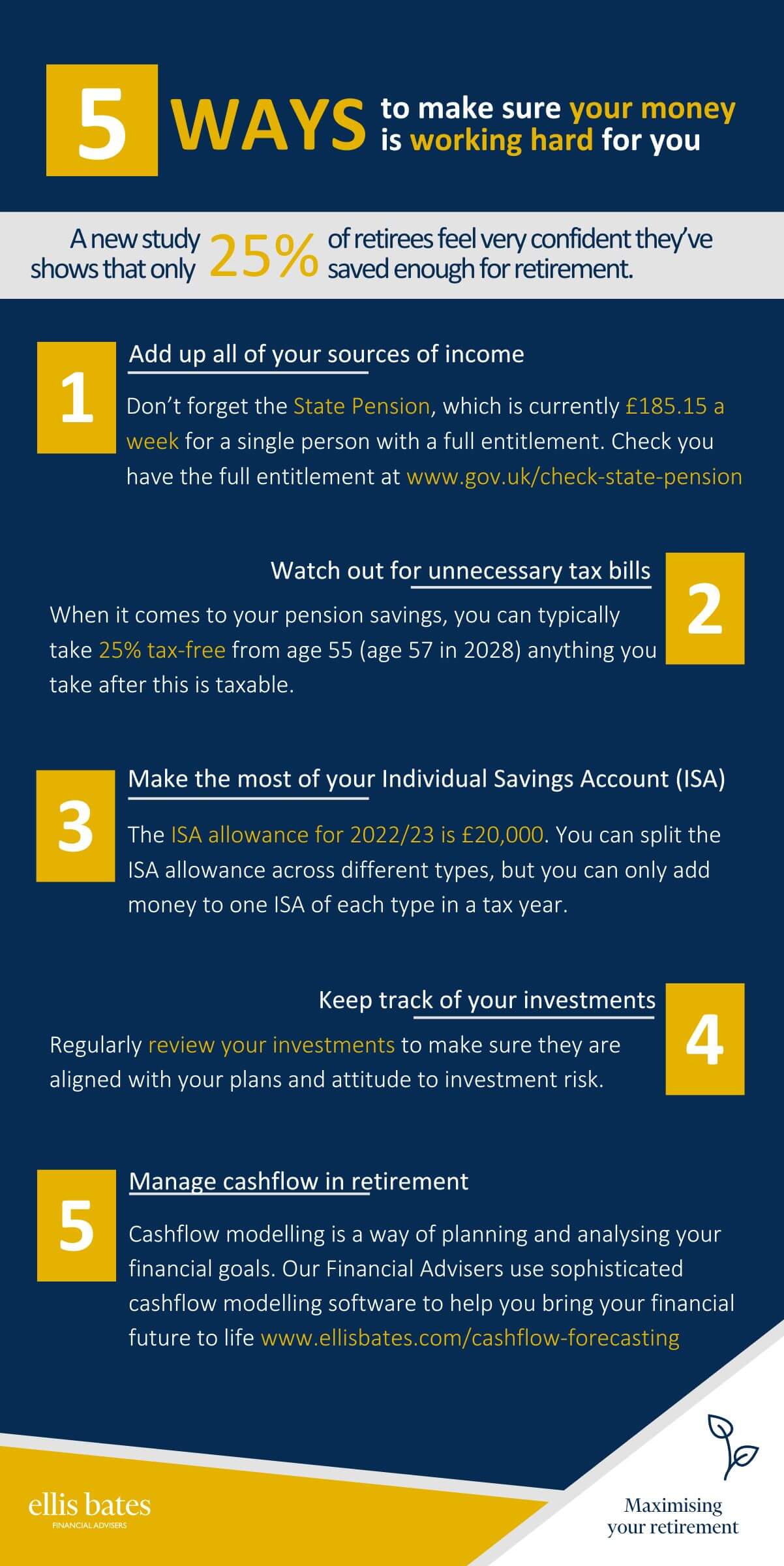

Financially advised consumers expect to fund their retirement for a longer period, with an average of 23 years, compared to 17 years for non-advised people before pertinent cutbacks must be made. In addition, the study reveals that financial planning tends to be beneficial for people already in retirement.

Almost all (96%) of wealthy retirees who did a great deal of financial planning or just planned their finances slightly say they’re enjoying their retirement, dropping to 72% among those who have done no financial planning.

How much do I need to retire

Regrets for non-advised retirees are more pronounced, with the majority stating that they require more money in retirement compared to their original estimates, and that they wished they had planned more thoroughly, compared to advised people.

Despite having a higher household income, 23% of wealthier pensioners, with an income of between £40,000 and £49,999, wished they had planned more thoroughly, indicating that the value of advice remains consistent regardless of income.

Retirement Planning Services

Planning for retirement can be overwhelming, leading to several considerations, making financial advice crucial for people to feel more confident and prepared about their future. The research results underscore the significant variation between the retirement plans and experiences of those who have taken advantage of financial advice and those who haven’t.

The research findings demonstrate the value of professional financial advice in terms of the retirement age and the enjoyment of one’s retired life. Start planning today, and take the first step towards a brighter tomorrow.

Financial Planning Services

Financial planning can certainly feel complicated at first glance, but with the right guidance, it can be a smooth and stress-free process. At every step of your financial planning journey, we’re dedicated to providing you with accessible financial advice to support you in making informed decisions about your finances.

Cash Flow Forecasting

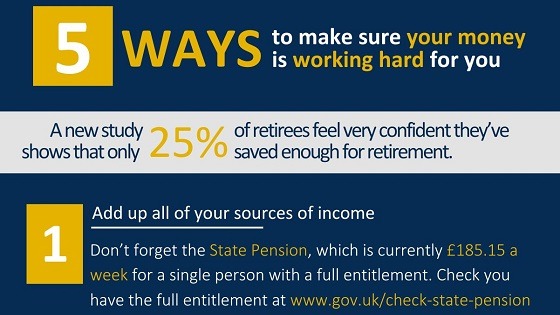

Our Financial Advisers use sophisticated cash flow forecasting software which helps you to visualise your expenditure, income and preferred lifestyle. It also allows us to simulate different scenarios and stress test how much financial resilience you may have to factors outside of your control, such as life events, economic changes and volatile markets.

If you have any concerns about your financial future or would like to find out more, please contact us.

Source data: [1] Boxclever conducted research for Standard Life among 6,000 UK adults. Fieldwork was conducted between 6 Sept–16 October 2022. Data was weighted post-fieldwork to ensure the data remained nationally representative on key demographics. Comparisons to data from last year are taken from Boxclever research among 4,896 UK adults conducted between 16-23 July 2021.