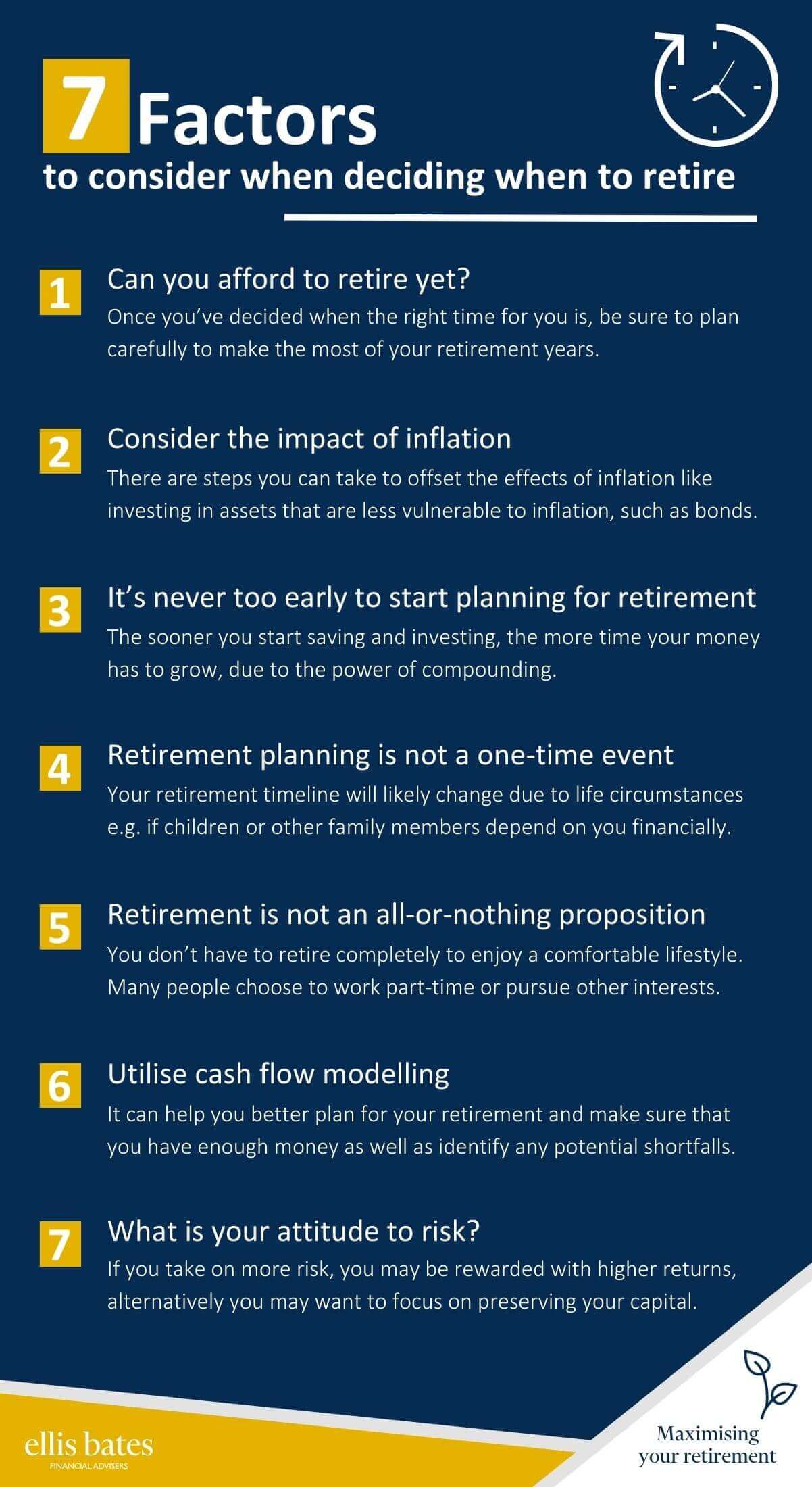

1. Can you afford to retire yet?

Once you’ve decided when the right time for you is, be sure to plan carefully to make the most of your retirement years.

2. Consider the impact of inflation

There are steps you can take to offset the effects of inflation like investing in assets that are less vulnerable to inflation, such as bonds.

3. It’s never too early to start planning for retirement

The sooner you start saving and investing, the more time your money has to grow, due to the power of compounding.

4. Retirement planning is not a one-time event

Your retirement timeline will likely change due to life circumstances e.g. if children or other family members depend on you financially.

5. Retirement is not an all-or-nothing proposition

You don’t have to retire completely to enjoy a comfortable lifestyle. Many people choose to work part-time or pursue other interests.

6. Utilise cash flow modelling

It can help you better plan for your retirement and make sure that you have enough money as well as identify any potential shortfalls.

7. What is your attitude to risk?

If you take on more risk, you may be rewarded with higher returns, alternatively you may want to focus on preserving your capital.

Get in touch

For more information on our retirement planning services and how we can help you answer questions such as “how much do I need to retire”? and “can I take early retirement?”, please get in touch.