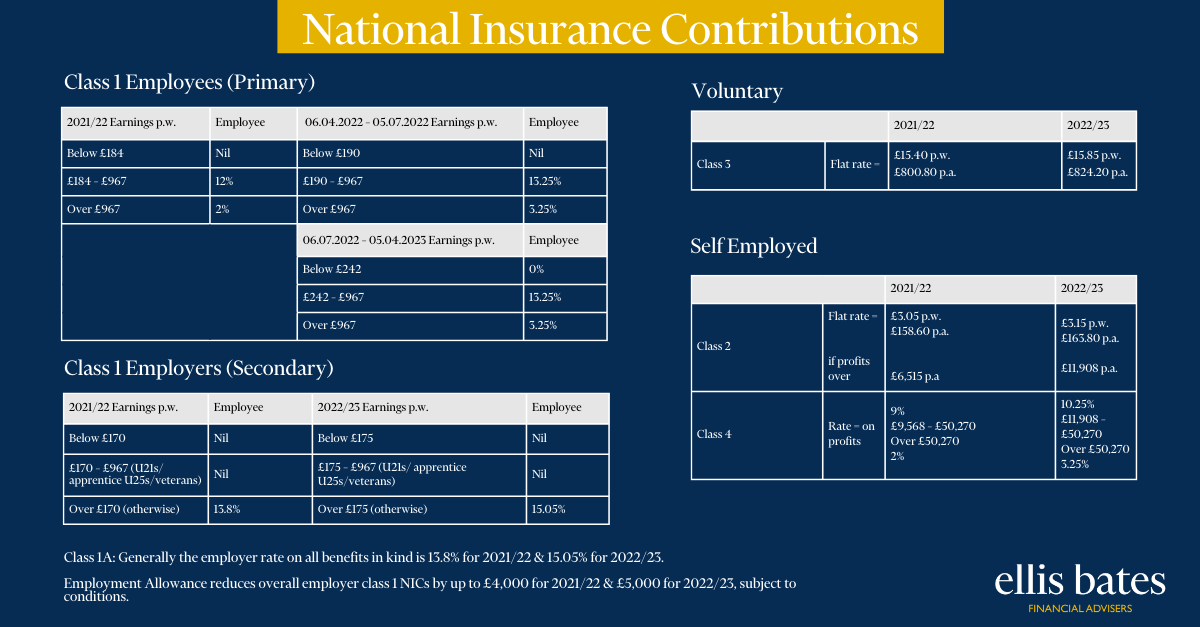

Class 1 Employees (Primary)

| 2021/22 Earnings p.w. |

Employee | 06.04.2022 – 05.07.2022 Earnings p.w. | Employee |

| Below £184 | Nil | Below £190 | Nil |

| £184 – £967 | 12% | £190 – £967 | 13.25% |

| Over £967 | 2% | Over £967 | 3.25% |

| 06.07.2022 – 05.04/2023 Earnings p.w. |

Employee | ||

| Below £242 | 0% | ||

| £242 – £967 | 13.25% | ||

| Over £967 | 3.25% | ||

Class 1 Employees (Secondary)

| 2021/22 Earnings p.w. | Employer | 2022/23 Earnings p.w. | Employer |

| Below £170 | Nil | Below £175 | Nil |

| £170 – £967 (U21s/apprentice U25s/Veterans) | Nil | £175 – £967 (U21s/apprentice U25s/Veterans) | Nil |

| Over £170 (otherwise) | 13.8% | Over £175 (otherwise) | 15.05% |

Class 1A: Generally the employer rate on all benefits in kind is 13.8% for 2021/22 & 15.05% for 2022/23.

Employment Allowance reduces overall employer class 1 NICs by up to £4,000 for 2021/22 & £5,000 for 2022/23, subject to conditions.

Voluntary

| 2021/22 | 2022/23 | ||

| Class 3 | Flat rate = | £15.40 p.w. £800.80 p.a. |

£15.85 p.w. £824.20 p.a. |

Self Employed

| 2021/22 | 2022/23 | ||

| Class 2 | Flat rate =

If profits over |

£3.05 p.w.

£158.60 p.a.

£6,515 p.a. |

£3.15 p.w.

£163.80 p.a.

£11.908 p.a. |

| Class 4 | Rate =

On profits |

9%

£9,568 – £50,270 Over £50,270 2% |

10.25%

£11,908 – £50,270 Over £50,270 3.25% |