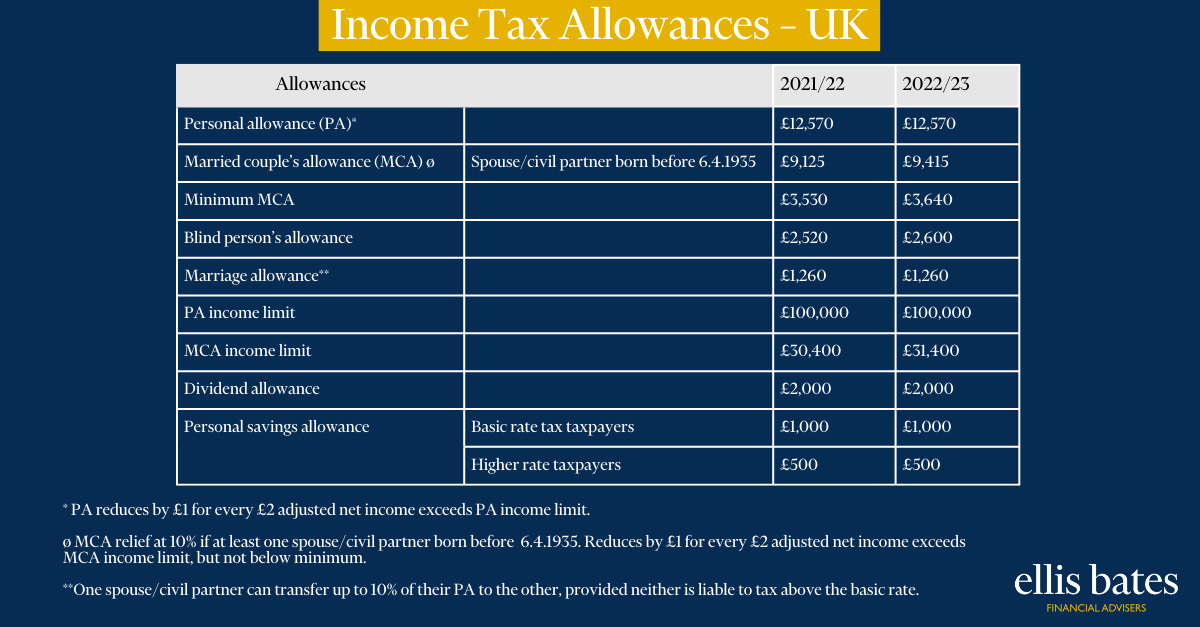

Income Tax Allowances – UK

| Allowances | 2021/22 | 2022/23 | |

| Personal allowance (PA)* | £12,570 | £12,570 | |

| Married couple’s allowance (MCA) Ø | Spouse/civil partner born before 6.4.1935 | £9,125 | £9,415 |

| Minimum MCA | £3,530 | £3,640 | |

| Blind person’s allowance | £2,520 | £2,600 | |

| Marriage allowance** | £1,260 | £1,260 | |

| PA income limit | £100,000 | £100,000 | |

| MCA income limit | £30,400 | £31,400 | |

| Dividend allowance | £2,000 | £2,000 | |

| Personal savings allowance | Basic rate tax taxpayers | £1,000 | £1,000 |

| Higher rate taxpayers | £500 | £500 |

* PA reduces by £1 for every £2 adjusted net income exceeds PA income limit.

ø MCA relief at 10% if at least one spouse/civil partner born before 6.4.1935. Reduces by £1 for every £2 adjusted net income exceeds MCA income limit, but not below minimum.

** One spouse/civil partner can transfer up to 10% of their PA to the other, provided neither is liable to tax above the basic rate.