How much is the pension lifetime allowance?

There have been several changes in the limit, from £1.25m, to £1m and now for the current tax year the lifetime allowance is £1.0731m.

Will my pensions exceed the lifetime allowance?

If you have a generous workplace pension or have saved significant amounts into personal pensions, it really is worth checking the value of these pensions against the LTA to ensure you don’t go over this limit.

This calculation is complex, and depends on the type of pensions you have and whether you are already taking lump sums or an income from these pensions.

Defined Contribution (DC) pension

This type of pension is usually built up from both personal and employer contributions which are invested over your lifetime to provide a pot of money for retirement. You need the total fund value, found on your annual statement(s) and the fund value includes both contributions and growth value.

Defined Benefit/Final Salary pension

These types of pensions your retirement income is based on your salary and the length of time you worked for your employer(s). Rather than showing a ‘fund value’, your annual statement shows the pension you are on track to receive at retirement.

For LTA purposes you need to multiply this annual pension by 20 to get the theoretical ‘fund value’. Many final salary schemes offer a tax-free lump sum, before income begins and may be in addition to your full pension income or by reducing your pension income to provide the lump sum. The calculations can be complex and we encourage you to speak to a Financial Advisor who is licensed to deal with these types of pension.

Lifetime Allowance if your pension is already paying out

If you have started taking an income from a DC pension since the LTA was introduced on 6 April 2006, you should have been assessed already. Your pension provider or Financial Advisor will be able to confirm the figure that was calculated.

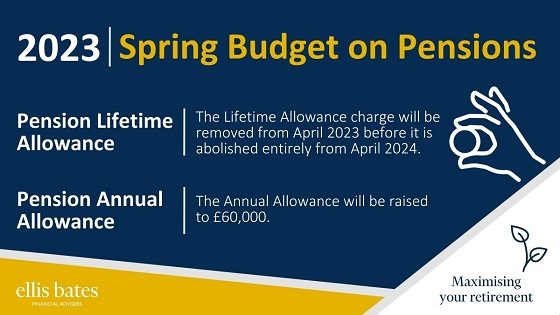

What is Pension Lifetime Allowance (LTA)?

What is Pension Lifetime Allowance (LTA)?