Maximise Individual Savings Accounts (ISAs)

You can put the entire amount into a Cash ISA, a Stocks & Shares ISA, an Innovative Finance ISA or any combination of the three. Usually when you invest, you have to pay tax on any income or capital gains you earn from your investments. But with an ISA, provided you stick to the rules on how much you can pay in, all capital gains and income made from your investments won’t be taxed. Every year you have an ISA allowance, which is currently £20,000 for the 2023/24 tax year.

Capital gains tax – utilise any capital losses

If you realise capital gains and losses in the same tax year, the losses are offset against the gains before the capital gains tax exempt amount (£6,000 in 2023/24) is deducted. Capital losses will be wasted if gains would otherwise be covered by your exempt amount. Consider postponing a sale that will generate a loss until the following tax year or, alternatively, realise more gains in the current year.

Income tax – Check your PAYE code

It’s important to check your tax code as it is based on the amount of income tax you should be paying and the amount you can earn before tax applies.

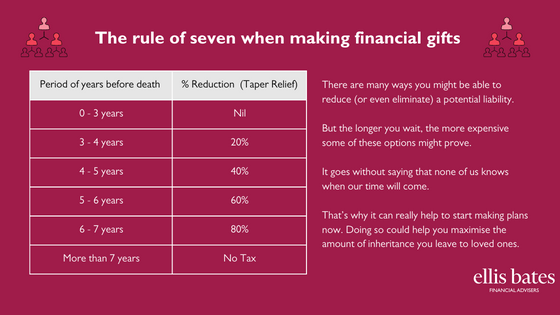

Reduce inheritance tax liability

Inheritance tax is chargeable at 40% on any assets above £325,000 (up to £500,000 if the Residence Nil-Rate Band is available) so understanding how to manage your estate which is made up of your pensions, property, savings, investments etc as tax-efficiently as possible is vital.

We work with you to ensure you maximise all tax relief available and to look at all your current and future finances to mitigate a whole range of liabilities including inheritance tax, income tax and capital gains tax.

We work with you to ensure you maximise all tax relief available and to look at all your current and future finances to mitigate a whole range of liabilities including inheritance tax, income tax and capital gains tax.