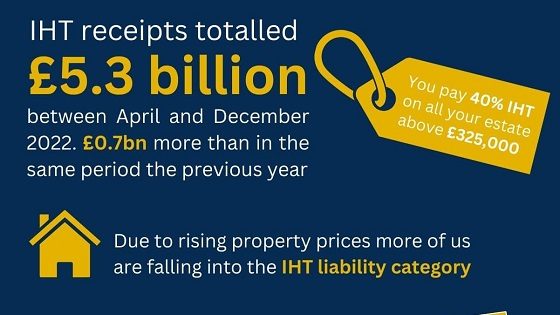

Tax Planning Services

https://www.ellisbates.com/wp-content/themes/osmosis/images/empty/thumbnail.jpg 150 150 Jess Easby Jess Easby https://secure.gravatar.com/avatar/70f816837c455030814d46a740cfc12d89893aaf8cbf8c8f8f59387d7b30ac08?s=96&d=mm&r=gHead of Estate Planning and Chartered Financial Planner, Mark Chandler, outlines our tax planning services including making a Will, trusts and probate. Find Your Local Adviser